Using Your Home Like an ATM Machine

In the video below Joe Parker, partner with the Santa Barbara Group talks about the importance of keeping equity in your home.

Joe is an avid reader of real estate market trends. He recently read an article about the rise in homeowners taking out equity lines (HELOC) in their homes. This was something we saw a great deal of prior to the market crash of 2007.

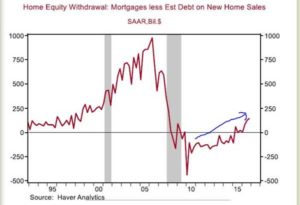

The graph to the right shows the rise in equity lines of credit 10-15 years ago. It also indicates there is another rise happening now. Some call this process, “Using Your Home Like An ATM Machine.”

Joe and Garrett simply want their clients and readers to be thoughtful about tapping into their home’s equity. Santa Barbara real estate is less volatile than most US markets, yet even here we experience market swings. You never know when you might need to sell your place and being upside down means coming out of pocket at the closing table.

A rule of thumb suggests maintaining a positive equity in the 20+% range is wise.

If you have questions about where the market is heading, best practices with investment properties or anything else real estate related, please know Joe and Garrett are here for you. As one of the nation’s top real estate groups, they have the experience you can trust.

Watch Joe Parker’s Video About Home Equity

Best to you,

Joe Parker & Garrett Thomas

The Santa Barbara Group

Berkshire Hathaway Home Services CA

Response to "Using Your Home Like an ATM Machine"